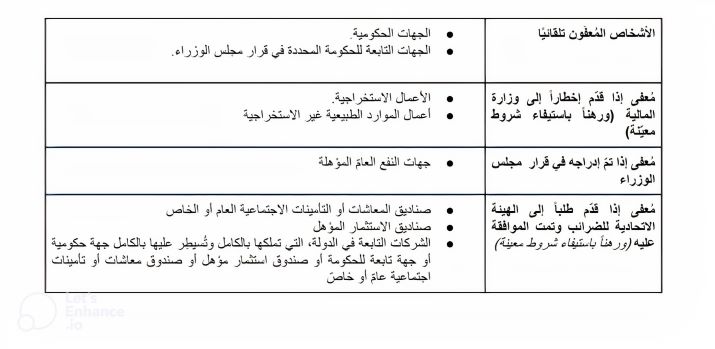

Certain types of businesses or establishments are exempt from corporate tax due to their importance and contribution to the social fabric and economy of the UAE. These are known as exempt persons and include:

In addition to not being subject to corporate tax, government and government entities specified in the Cabinet Resolution, extractive businesses and non-extractive natural resource businesses may also be exempt from any tax registration, tax filing or other compliance obligations under corporate tax, unless You carry on an activity that falls within the scope of corporate tax.

According to the tax systems in force in most countries, the corporate tax law imposes a tax on income based on residence and origin. The applicable basis depends on the classification of the taxable person.

A “resident person” is subject to tax on income generated from both domestic and foreign sources (ie on the basis of residence).

A “non-resident person” is subject to tax only on income generated from sources within the country (i.e. on the basis of origin).

Residence for corporate tax purposes is not determined by the place in which the person resides or has his registered office but rather by specific factors stipulated in the law Corporate tax If a person does not fulfill the conditions necessary to be treated as a resident or a non-resident person, then he will not be subject to tax and therefore no corporate tax will apply to him.

Your trusted partner for business setup, accounting, and corporate solutions across the UAE.

Copyright by thinkbizpro.com. All rights reserved.